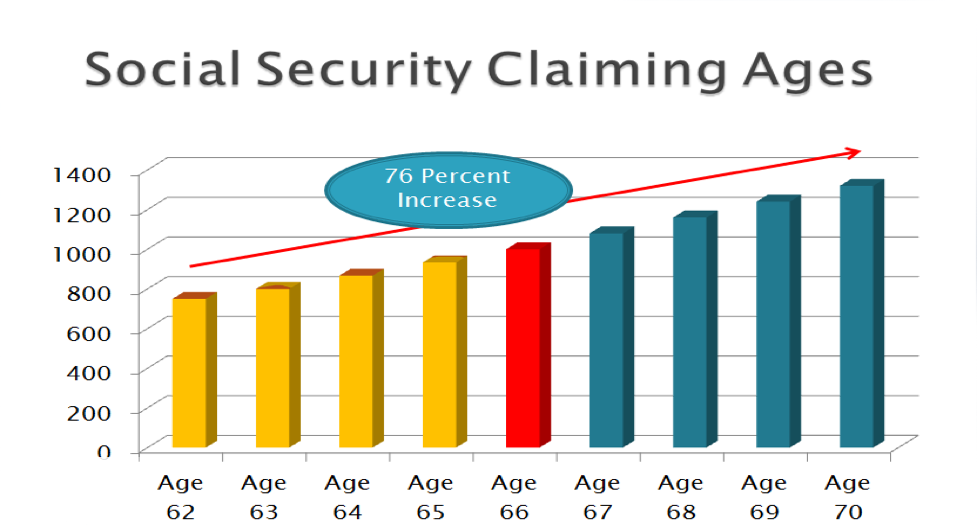

This chart shows a claimant, age 66, whose Social Security benefit at full retirement age (FRA) is $1,000/month. If this person claims benefits at age 62, the monthly benefit is $750, a reduction of 25%. However, if this claimant should wait until age 70 to claim benefits, the Social Security benefit would be $1,320, a whopping 76% increase in the benefit!

Did you know there are hundreds of Social Security claiming strategies? Choosing the right Social Security election may be the most important decision of your retirement. How much you receive from Social Security depends on three primary factors:

Since you can’t go back and change your earnings record, and you have minimal control over how long you live, calculating an expected lifetime benefit largely hinges on when and how you elect benefits. In theory, if you elect early, you will get a smaller benefit for a longer period of time. If you elect later, you will get a larger benefit for a shorter period of time.

Single people can do a simple “break-even” analysis to determine whether to take benefits early or wait. Divorced individuals also have options if they meet certain criteria. But for married couples, the decision is much more complex.

For married couples, a simple break-even analysis will usually give the wrong answer, costing you benefit dollars. Why? Because Social Security offers three distinct benefits for married people:

Virtually all of the simple break-even calculators in use today ignore the spousal and survivor benefits. Complex planning software includes spousal and survivor benefits but only for one combination of election ages. In short, neither tool offers a thorough analysis.

Using a comprehensive software analysis tool, we can examine election strategies to help you find the option that offers the highest expected lifetime benefit. Call us today at 954-478-2217 to schedule an appointment to get your personalized Social Security Analysis report.

Free Chapter

Free Chapter

Denise Longshaw, aka "the DROP Lady," is the President and Founder of Longshaw Financial Group.

Our financial strategies use insurance and investment products to help public sector employees meet their financial goals.